How Charlie Enhances the Borrower Experience

No matter the state of the industry, borrower satisfaction will always come first in mortgage lending. Lengthy forms, fragmented communication, and last-minute document issues not only frustrate your borrowers, but also cost your team valuable time and trust. This is where Charlie makes a difference: streamlining the entire lending journey with borrower-focused innovations.

Today’s blog focuses on three key aspects of how our configurable and dynamic platform improves the borrower experience:

Asking Only What’s Needed, When It’s Needed

The URLA: A critical document in the industry but it can be a slog to get through for the borrower.

What if there was a better way to obtain this information?

What if instead of presenting a bunch of fields that don’t apply to each borrower or making users hunt for a specific field to fill out, the form changed based on how your customer is answering questions?

Enter Charlie’s Consumer Interview.

Charlie simplifies data entry with dynamic screens that ask for the right information at the right time. This means borrowers aren’t overwhelmed with endless fields or irrelevant questions upfront. By presenting fields based on what’s already known about the loan and borrower, Charlie reduces confusion and makes the application feel tailored and efficient.

The best part? It is configurable to meet your business needs.

Keeping Everyone on the Same Page

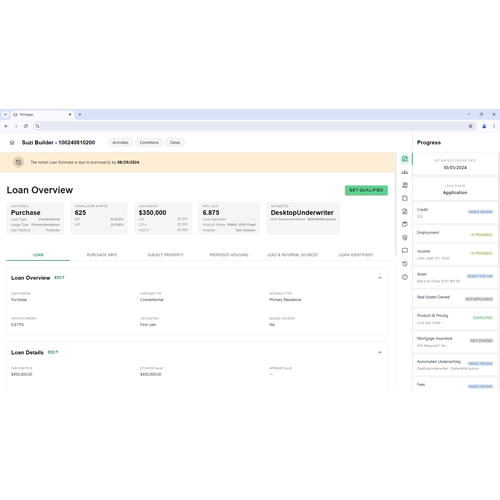

One system. From the inception of Wilqo, one system is all we have ever known.

One of Charlie's greatest strengths is that it is a fully consolidated platform. All stakeholders, including loan officers, underwriters, and the borrower, work within the same system. This “single source of truth” eliminates the inherent hassles of trying to share data between multiple apps and significantly improves team collaboration while eliminating the risk of things slipping through the cracks.

No more having to sync between the LOS and POS, no more data discrepancies; the information is all in one place.

With features like automated task assignments and role-specific permissions, everyone knows exactly what they need to do without having to worry about whether or not they are working with the right information.

Proactive Document Management

Nothing derails a smooth closing quite like an expired document.

Our in-app reporting flags documents that are set to expire before the scheduled closing date. This means your team can proactively reach out to borrowers to refresh outdated information, avoiding last-minute scrambles and ensuring compliance throughout the process.

It’s about being ahead of the game rather than playing catch-up.

Think about how many times you had to ask your borrower for some documentation at the last minutes … or worse, after the loan is closed and they have no motivation to help you out. Now imagine a world where that never happens again …

Conclusion

Charlie doesn’t just simplify the mortgage process; it transforms it. By focusing on the borrower’s journey, improving team collaboration, and proactively managing crucial details, Charlie ensures a seamless experience for both clients and your lending team.

It’s an innovative, practical solution that helps you close more loans with less stress.

Subscribe to our weekly email:

Share this

You May Also Like

These Related Stories

Creating an Intuitive User Experience: How Wilqo Simplifies the Loan Process

The LOS–POS Divide Is Broken. Here’s Why We Ended It.