Overcoming Some of the Top Challenges Facing Mortgage Lenders Today

This past week our Chief Strategy Officer, Rob Katz, had the opportunity to sit down with mortgage industry influencer Robbie Chrisman and is featured in today's Chrisman Commentary Podcast.

Read on to understand the nature of their conversation, the challenges facing lenders today, and how those challenges can be overcome.

Mortgage lenders are navigating through complex challenges in today's lending environment, many of which can be traced back to outdated systems and processes. As loan volumes shift and the market becomes more competitive, it’s crucial to address the inefficiencies that impact the bottom line. Here are three major pain points for mortgage bankers and how innovative solutions can help overcome them:

- Talent Misalignment

One of the biggest issues is that highly skilled (and highly paid) professionals are stuck doing routine, low-value tasks.

For example, a process could have underwriters reviewing every aspect of an appraisal, when in reality, only a few high-risk items truly need their attention.

- Out of 80 tasks, they may only need to handle 4.

- The rest could be automated or delegated to less expensive team members.

This talent misalignment wastes time and resources and ultimately limits productivity, with underwriters often only touching two files per day due to "busy work."

This inefficiency stems from lenders relying on outdated, linear workflows that can only support one person in a file at a time. Modernizing with non-linear, parallel workflows would allow lenders to align tasks with appropriate skill levels, freeing up their experts for higher-value work. Our Production Optimization Platform, Charlie, solves for this.

- System Complexity

Many lenders operate with a patchwork of disconnected systems.

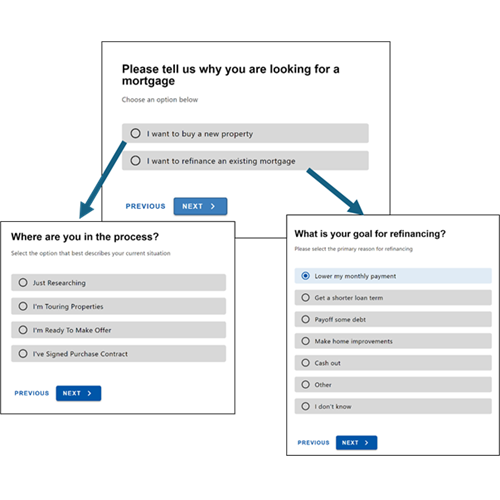

For instance, operations likely uses one platform while borrowers use another for updates, document uploads, or status tracking. This fragmented approach makes it difficult to keep data in sync and creates unnecessary administrative overhead. Moreover, adding automation or reporting features to legacy systems often slows things down further.

Streamlining your tech stack is key.

Instead of relying on multiple tools that don't communicate well with each other, a unified platform, like Charlie, ensures everyone, including borrowers, works from the same system. This reduces errors, improves speed, and simplifies training, ultimately improving the borrower experience and reducing operational costs.

- Talent Recruitment and Retention

Recruiting and retaining experienced loan officers and underwriters is becoming more difficult. Many seasoned professionals are aging out of the workforce, while younger talent is deterred by the outdated processes many lenders still use.

To attract top talent, lenders need to offer a modern, streamlined system that allows loan officers to focus on selling rather than navigating cumbersome workflows. Additionally, reducing the complexity of training by using intuitive, user-friendly tools can help onboard new recruits faster, even those with less industry experience.

Where Does AI Fit In?

AI is transforming many industries, and mortgage banking is no exception. However, it’s essential to focus on the right AI projects. While some lenders are experimenting with big AI initiatives, like virtual loan officers or fully automated underwriting, we believe this is premature for most.

Instead, focus on practical AI tools. Use AI to optimize marketing campaigns, standardize workflows, and enhance analytics. By focusing on practical, low-risk AI implementations, you can streamline operations without the regulatory and ethical risks that come with fully automated decision-making.

Conclusion: The Future is Here

At Wilqo, we’ve built Charlie, a cloud-native Production Optimization Platform designed to solve these problems. By leveraging automation, streamlining workflows, and enhancing collaboration across your teams, we can help you improve throughput, reduce costs, and attract top talent. It’s time to rethink how loans get done — and Charlie is leading the way.

Subscribe to our weekly email:

Share this

You May Also Like

These Related Stories

Introducing the First Production Optimization Platform (POP) in the Mortgage Industry

Planning 2025: Insights from Andrew Andreasen, COO of Mortgage Pro Home Loans