Tackling System Complexity in Mortgage Lending

One of the persistent challenges for mortgage lenders today is managing system complexity. When core systems like the Loan Origination System (LOS) and the Point of Sale (POS) are separate, lenders and borrowers face a host of operational inefficiencies. This fragmented setup forces borrowers to interact with one system for document uploads, status updates, and queries while lenders and loan officers work primarily within the LOS.

Let’s break down the key challenges and the solution.

The Challenges:

- Data Synchronization: Keeping the POS and LOS aligned is no small feat. Discrepancies in borrower data or loan status updates can lead to errors, delays, and frustrated borrowers. For loan officers and other stakeholders, knowing which system has the most current data becomes a daily struggle.

- Administrative Burden: Managing two separate systems requires dual administration efforts. Every configuration update, integration patch, or report requires alignment across both platforms, creating overhead for support staff and increasing risks of misalignment.

- Slow System Performance: Lenders often resort to add-ons and plug-ins to compensate for the lack of automation and coordination across their platforms. Ironically, these “solutions” can slow down the entire system, introducing bottlenecks and increasing the time spent on critical tasks.

A Smarter Approach:

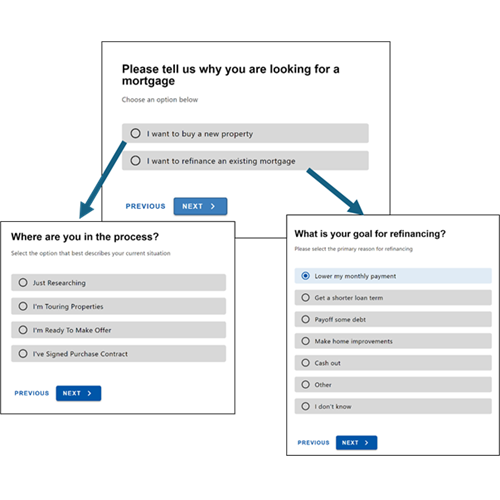

The key to overcoming these issues lies in having a unified platform that consolidates POS and LOS functionalities. Charlie does just that. Here’s how:

- Single, Unified Platform: Charlie was built from day one to cover both POS and LOS functionality (and more). This approach eliminates the need to sync multiple systems manually, reducing errors and improving consistency. And, when you do need to make an administrative change, you only have to do it one time!

- Dynamic Workflows and Automation: With built-in automation, Charlie helps streamline repetitive tasks and ensures that services and processes flow seamlessly. This not only improves accuracy but also boosts efficiency by removing the reliance on manual synchronization.

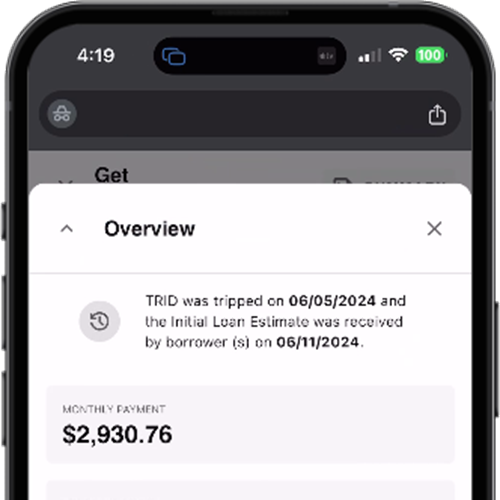

- Simplified User Experience: A straightforward, user-configurable experience means that only the right information is shown to the right user at the right time. The cloud-native architecture optimizes performance and allows multiple users to work on the same loan concurrently without causing data conflicts.

By reducing complexity, lenders can focus more on delivering a great borrower experience, closing more loans faster, and lowering operational costs.

Subscribe to our weekly email

Share this

You May Also Like

These Related Stories

How Charlie Enhances the Borrower Experience

The Challenge of Talent Recruitment