Streamline Your Loan Origination Process with Wilqo's Get Qualified Workflow

In the fast-paced world of mortgage lending, efficiency and accuracy are key to maintaining a competitive edge. That's why Wilqo is proud to introduce the Get Qualified workflow in Charlie, our Production Optimization Platform (POP).

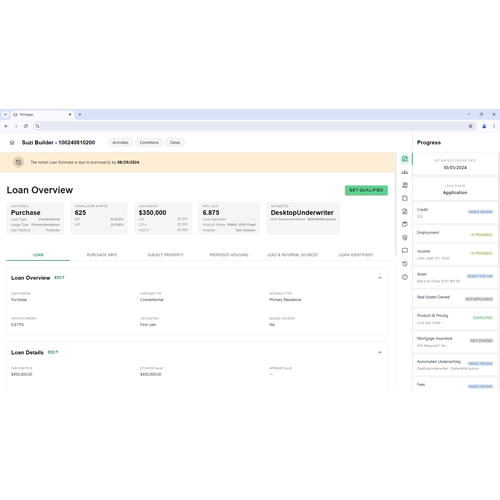

This groundbreaking feature is designed to streamline the data capture and review process for Loan Officers (LOs) by consolidating borrower information into a single, easy-to-navigate interface, setting Wilqo apart from competitors.

One-Stop Solution for Borrower Information

One of the standout features of the Get Qualified workflow is its comprehensive dashboard. Loan officers can effortlessly capture and review borrower details without the need to switch between different screens or applications. This unified interface not only saves time but also minimizes the risk of errors, ensuring that all relevant information is readily available at the LO’s fingertips.

The left-hand panel of the workflow includes the various steps an LO can take to gather borrower information and trigger integrations (credit, fees, product search and rates, and AUS). From personal information to employment and income, assets, and credit liabilities, every aspect of the borrower's profile can be managed from this centralized hub.

Real-Time Summary and Document Access

Another unique advantage of the Get Qualified workflow is the real-time summary panel on the right-hand side of the screen. This panel provides a snapshot of crucial loan metrics such as monthly payment, loan-to-value (LTV) ratios, debt-to-income (DTI) ratios, credit scores, and estimated closing costs. This feature allows LOs to quickly assess the loan status and make informed decisions without having to dig through multiple documents.

Moreover, the Get Qualified workflow includes direct access to essential documents like credit reports. This seamless integration means that LOs can order, review, and validate credit information without leaving the workflow, enhancing both speed and accuracy in the loan qualification process.

Unique Benefits for Loan Officers

The benefits of using Wilqo's Get Qualified workflow include:

Efficiency

Consolidating all borrower information into a single workflow reduces the time spent navigating different parts of the software. This efficiency translates into faster loan processing times, which can significantly enhance customer satisfaction.

Accuracy

With all relevant data displayed in one place, the likelihood of missing or incorrect information is drastically reduced. This accuracy is crucial in maintaining compliance and ensuring smooth loan approval processes.

User-Friendly Interface

The intuitive design of the Get Qualified workflow means that Loan Officers can easily adapt to the system with minimal training. This user-friendly interface is a testament to Wilqo's commitment to providing a seamless user experience.

Comprehensive Overview

The real-time summary panel provides a quick overview of the loan's key metrics, allowing LOs to make informed decisions on the spot. This feature is particularly useful for identifying potential issues early in the process and addressing them proactively.

Standing Out in the Market

Charlie’s Get Qualified workflow represents a significant advancement in loan origination technology. Unlike other systems that require LOs to jump between multiple screens and applications, Wilqo offers a streamlined, all-in-one solution that enhances productivity and accuracy. This distinctive approach not only improves the efficiency of the loan origination process but also positions Wilqo as a leader in the mortgage technology space.

The Get Qualified workflow is a powerful tool that can transform the way loan officers manage borrower information. By integrating all necessary functions into a single, user-friendly interface, Wilqo ensures that LOs can focus on what they do best—providing exceptional service to their clients. If you're looking to enhance your lending operations, it's time to experience the Wilqo difference.

Share this

You May Also Like

These Related Stories

Creating an Intuitive User Experience: How Wilqo Simplifies the Loan Process

Enhancing Loan Origination Efficiency: Wilqo's Partnership with Polly