A Q&A with Industry Leader and Wilqo Board Member, Larry Huff: Reflecting on Wilqo’s first Thought Leader Summit.

Ten Sleep, Wyoming. Untouched beauty, a rugged but timeless terrain. The perfect setting to clear the mind and focus on what matters most for the mortgage industry.

Last week members of Wilqo met with several executives of our existing and future clients to discuss how best to fix the loan manufacturing process.

Today we sat down with Larry Huff, one of Wilqo’s Co-Founders and Board Members, and Co-Founder of Optimal Blue, to hear his perspective on what was covered at the Summit.

With over 20 years of executive experience in technology, business, and product development, this setting was the perfect opportunity to gain insight from the thought leaders in the mortgage industry.

Q: What were the most valuable takeaways from the Thought Leader Summit?

Larry: Lenders know the industry is broken. They know there must be a better, more efficient way to get a loan done that not only streamlines the process for borrowers, but helps reduce the time, energy and cost to get to a closed loan. The problem they have faced is that the current technology solutions out there are dated and put unwanted constraints in place that block the progress lenders want to make.

We are about to go into another volume upswing, and smart lenders are thinking “I can’t believe we have to repeat how we’ve always handled more volume – hiring more people and clogging up our process.”

So, there are plenty of lenders who want to change , but the industry has not had a proper solution.

All of the lenders at the Summit are excited about what Wilqo offers in our Production Optimization Platform and they can see how much better things are going to be for all parties involved in the process moving onto a modern solution like ours. As a co-founder in Wilqo, it was rewarding to hear the universal praise confirming we are on the right path.

Q: How did the discussion reflect the current needs and pain points of lenders? How does our software uniquely solve those challenges?

Larry: The needs were well established going into the meetings:

- Reduce the costs (direct and indirect) for producing loans

- Improve the borrower’s experience

- Eliminate the crazy staffing yo-yo cycles of growing and shrinking team sizes

- Speed up the overall process to get loans closed faster

We actually spent time going in depth with each lender about each of these challenges, which was great for all participants to hear. There was certainly some value in each lender hearing that they aren’t alone facing these obstacles.

The hard part is that while there are many over-arching pain points, the path to success is not clear.

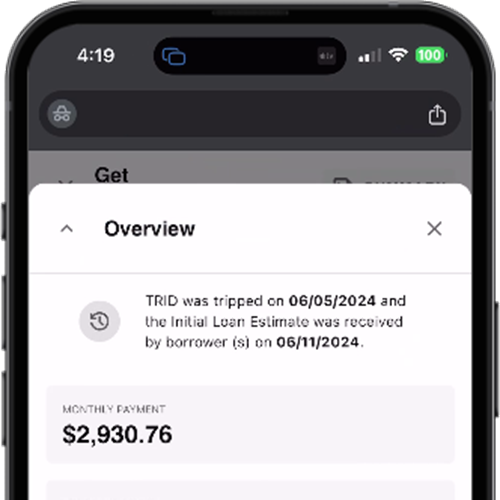

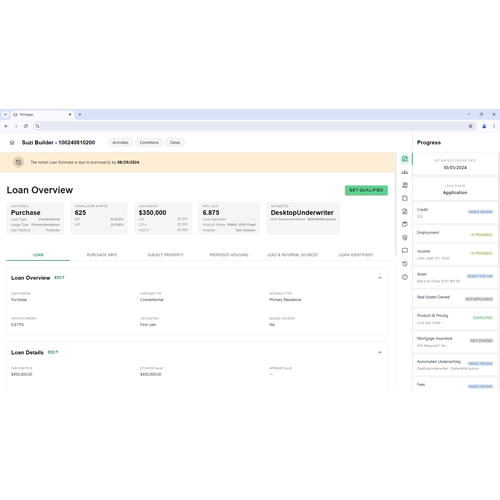

Although all the participants were familiar with our solution, called Charlie, we surprisingly spent a fair amount of time diving deep into functionality to show how a new way of doing loans truly could solve the problems they run into day-to-day. Our guests were pleasantly surprised by the depth of capabilities in Charlie.

Q: Which insights from the summit were most surprising or reaffirming in terms of the future of mortgage technology?

Larry: Lenders want to change, but know that change can be very, very hard. The two biggest perceived obstacles are the depth of integration into the lender’s current LOS, and the anticipated pushback some members of their staff will have when they are faced with learning a new way to do their jobs.

This uprooting of their current system is perceived to be very high risk, but as we dug in deeper during the Summit, it became clear that the risk was just that – perceived. For the concerns around staff reaction to a new platform, the conversations ended up focusing on the career-pathing opportunities that being on Charlie would introduce, along with the ability to bring on new folks with less experience who could have a meaningful impact on the loan process with very little training. The truth is, some old-school thinkers may not fit into a new paradigm for a lender, and the resulting changing of the guard could be a healthy event for lenders who want to change.

Q: What trends discussed do you think will shape the mortgage industry in the coming years?

Larry: The emerging (younger) demographics driving change in the industry. Adoption of systems like Truv and Plaid, etc. Lenders are learning how to coach consumers who are not only new to the process, but in large part consume and process information unlike generations before.

Throughout our discussions, several of the lenders referred to the “old guard” who should be excited to be able to spend more time making meaningful, more frequent value-added decisions, and the “new guard” who will be attracted to join the mortgage banking industry because they will be working on modern technology that just makes sense.

Q: Final Thoughts: For companies hesitant about adopting new technology or making a switch from their current platform, what advice would you share from the Summit to ease that transition?

Larry: Patience and courage. Change is difficult and historically risky. We have a terrific group of early adopters who will be closing loans and showing that things truly are different with a POP (Production Optimization Platform). This is an exciting time to be on the front-line of innovation in the industry with the opportunity to take their business to a new level of success.

About Wilqo

Wilqo offers a cloud-native platform that optimizes the mortgage process from end to end, ensuring accuracy, efficiency, and full compliance with all regulatory requirements. We’re committed to driving innovation in lending while delivering an exceptional experience for borrowers, lenders, and partners alike.

Sign Up Below For Our Weekly Blog Email:

Share this

You May Also Like

These Related Stories

Streamline Your Loan Origination Process with Wilqo's Get Qualified Workflow

Creating an Intuitive User Experience: How Wilqo Simplifies the Loan Process