Insights from John Haring: How to Get Ahead of Compliance in Q1 2025

As the lending landscape evolves, so do compliance challenges. To help lenders navigate 2025’s regulatory demands, we spoke with John Haring, our Head of Compliance. He shared three pivotal strategies lenders should prioritize to stay ahead of the curve heading into the new year.

- Strengthen Your Reconsideration of Value Procedures

Why It Matters: Discrimination in property appraisals remains a critical issue, and lenders must ensure equitable treatment for all borrowers. The GSEs (Government-Sponsored Enterprises) now require a defined process to address appraisal discrepancies and inform consumers of their rights.

Key Actions:

- Establish a Transparent Process: Create a clear protocol for consumers to contest low appraisals. Equip teams to handle cases effectively when a borrower feels the value has been unfairly reduced.

- Consumer Communication: Develop a straightforward way to explain how concerns are addressed, ensuring borrowers understand their options and the steps involved.

- Proactive Training: Train staff to recognize potential bias and resolve discrepancies promptly.

- Refresh Training on Net Tangible Benefits for Refinances

Why It Matters: The regulatory focus on consumer benefit in refinances is intensifying, particularly with VA loans. The VA expects lenders to demonstrate that a refinance genuinely benefits the borrower, whether through lower rates, shorter terms, or accessing equity.

Key Actions:

- Refine Benefit Assessment: Implement a checklist ensuring all refinances meet tangible benefit criteria.

- Targeted Training: Focus on the nuances of VA loans, emphasizing strict adherence to benefit verification to avoid penalties.

- Audit Processes: Regularly review loan files to ensure compliance with net tangible benefit standards.

- Prepare for HMDA and State-Specific Reporting Early

Why It Matters: Accurate reporting for HMDA (Home Mortgage Disclosure Act) and state-specific Mortgage Call Reports is non-negotiable. Early preparation minimizes errors and penalties while ensuring your lending operations remain transparent.

Key Actions:

- Data Integrity: Begin reviewing your HMDA and call report data now, ensuring every entry is accurate and compliant.

- State-Specific Compliance: Familiarize yourself with unique state requirements to avoid last-minute rushes or inaccuracies.

- Leverage Technology: Use tools like automated reporting systems to streamline and validate data submission.

Conclusion

Compliance isn’t just about avoiding penalties—it’s about building trust and fostering equity in lending. By implementing these strategies, lenders can face 2025 with confidence. As John aptly notes, “Proactive preparation today lays the groundwork for smooth operations tomorrow.”

Subscribe to our weekly emails:

Share this

You May Also Like

These Related Stories

Maximize Your Profitability Through Compliance: Insights From John Haring

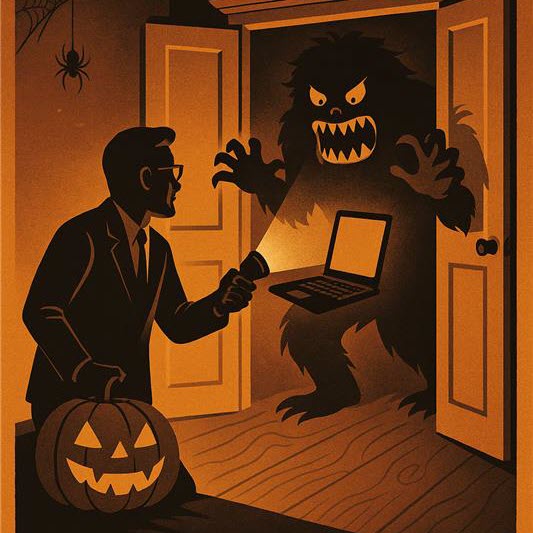

Taming the Compliance Boogeyman: A Halloween Tale of Tech and Triumph