Future-Proof Your Lending with Charlie’s Native Automation

Is Your Lending System Keeping Up?

As the mortgage lending landscape continues to evolve, maintaining automation capabilities becomes increasingly vital. Yet, many lenders find themselves tethered to outdated Loan Origination Systems (LOS) with limited, expensive, and difficult automation potential. If you are struggling to optimize your operations and know that there must be a better way, Charlie’s native automation will give you hope.

Why Choose Native Automation?

As the industry’s first Production Optimization Platform, Charlie is designed from the ground up with built-in automation, eliminating the need for external SDKs or custom integrations. This approach streamlines your operations by enabling automation to work seamlessly across the entire loan process.

Here is the first in a series of closer looks into how Charlie’s automation directly impacts your lending operations:

Run Services Without a Click and Handle the Outcomes With Ease

Many LOSs require manual initiation of essential services. With Charlie’s native automation, these services can be triggered as soon as relevant data is available.

Imagine this scenario around Flood …

You have high fallout in a state due to flood zone properties. While you already automate your flood certs, for this high-risk state you configure your system to run flood as soon as a subject property is entered.

A new loan for this state is entered into Charlie. This "positive" result automatically initiates a Flood Determination Check with your provider.

Uh oh… seconds later, the results come back that the house is going to need flood insurance.

So, Charlie then automatically adds a Flood Insurance condition to the loan and assigns an activity to your Loan Officer to have that hard conversation with the borrower.

Pause and read that last statement again.

No one had to order flood.

No one had to look at the report from the vendor.

No one had to condition the loan.

And no one had to pay a plug-in provider to build the automation.

That’s what native automation is all about.

And the bonus? You get to choose when you want things to run.

This level of smart workflow accelerates processing time, which is crucial for you in this competitive environment – especially now that volume is picking up.

Embrace the Future of Lending with Charlie

This is just a simple, but powerful, example of Charlie’s native automation.

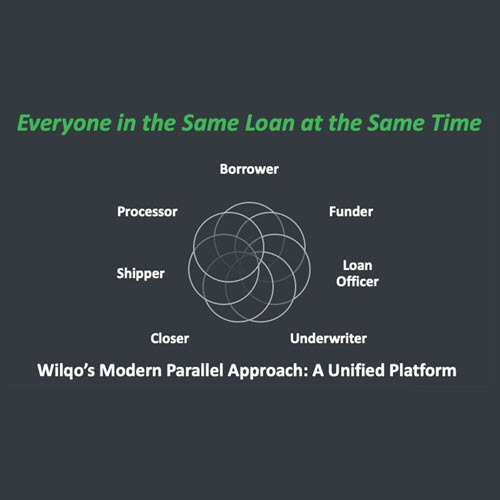

Think about the entire loan manufacturing process … aren’t next steps usually triggered by the outcome of a prior step completing?

Shouldn’t multiple things be able to happen at the same time?

Shouldn’t the system your entire business relies on be able to stitch pieces together natively to make things happen faster, cheaper, and more accurately?

Switching to a platform with built-in automation will not only bring you operational resilience, but also peace of mind because you know every loan will be handled the right way.

Don’t let an outdated system hold back your automation potential.

Subscribe to our weekly email:

Share this

You May Also Like

These Related Stories

The Importance of Data in AI for Mortgage Lending: Unlocking a New World with Charlie

How Charlie Enhances the Borrower Experience