Lance Reese, Wilqo's CEO, boasts an illustrious 30-year journey, blending technology with operational excellence across global industries.

Prior to Wilqo, Lance skyrocketed sharperimage.com's growth by 150% during his tenure as CEO. He led Amerimark Interactive, a $500M direct-to-consumer retail giant, and donned key roles from board memberships to COO and CIO stints at diverse companies, one being Docutech.

A tech aficionado from youth, Lance launched a tech consultancy at 16, evolving it into a pioneering contract management software venture for nuclear waste management.

A proud graduate of Indiana University and Brigham Young University with degrees in business administration and mathematics, Lance's commendation at the Indiana Kelley School of Business Academy of Alumni Fellows in 2021 is testament to his dedication. He continues to nurture his connection with Kelley, offering MBA students insights via case study endeavors.

Orlando is home for Lance, where he cherishes moments with his family, including four children, their partners, and three grandchildren.

Our Brimma Suite: Fast, Simple & Dependable

Built with AI at its core, our solutions embed directly into workflows so lenders can see progress where it matters most.

Lenders face challenges that slow progress: repetitive manual tasks, too many clicks in the LOS, and processes that don’t always connect. The Brimma Suite was created to solve those challenges at the source.

Harness The Power of AI

AI-Powered Validation

Without centralized validations, issues can easily slip through the cracks. Our AI-driven validation processes ensure that data is thoroughly checked before automation is triggered, significantly reducing loan processing time.

AI-Driven Automation

Recurring tasks often require excessive human effort. Our solutions harness the power of AI to automate your manual tasks, allowing you to focus on the tasks that truly require a human touch.

AI-Based Prioritization

Users often lack guidance on what the most pressing tasks are across all of their assignments. Our solutions use AI to prioritize your workload, ensuring that you address the most critical tasks first.

AI-Enhanced Optimization

Disorganized systems can require more screens and time than necessary. Our solutions optimize your workflow by utilizing AI to make every task more efficient, ensuring your time is used effectively.

Our Suite of Solutions Reduce Friction at the Source

The suite is a collection of integrated applications that work together or individually, strengthening your existing Loan Origination System. Each solution reduces friction at critical points in the process, creating consistency and clarity for teams who manage complex tasks every day.

With automation that validates documents, guides submissions, and streamlines back-office steps, the Brimma Suite transforms complexity into workflows that move forward with confidence. Every tool is designed with one goal: to help lenders achieve measurable impact through clarity, consistency, and efficiency.

Our Suite of Solutions

Brimma | DocFlow

Our DocFlow is a state-of-the-art document management solution that seamlessly integrates with your existing document classification and data extraction tools.

It tackles the “last mile” problem in document processing, enhancing the efficiency and accuracy of your automation. Our DocFlow lets valid documents bypass tedious manual reviews, so your team can focus on what truly requires a human touch.

Brimma | LeadNexus

Our AI LeadNexus (BLN) revolutionizes lead management for mortgage loan officers with its cutting-edge AI capabilities. Designed as an AI-first speed-to-lead tool, VLN enhances lead conversion rates effortlessly.

By automating initial tasks, providing intelligent recommendations, and streamlining communication, VLN integrates seamlessly with existing lead sources. Its user-friendly interface enables loan officers to optimize productivity and achieve better results.

AI Voice-To-Loan App

Our AI Voice-to-LoanApp is a cutting-edge solution designed to streamline the loan application process. By leveraging advanced AI technology, our solution transforms borrower conversations into industry-standard data payloads, ready to be imported into any Loan Origination System (LOS).

This innovative tool allows loan officers to focus more on meaningful interactions with borrowers rather than getting bogged down by administrative tasks

AI Chat

Your streamlined solution for accessing loan data. Say goodbye to endless clicks and screen-hopping. With our AI Chat, accessing crucial information is fast, intuitive, and tailored to your needs.

From loan officers to processors, our easy-to-use interface frees up valuable time, ensuring seamless workflow efficiency. Welcome to the bridge to your data.

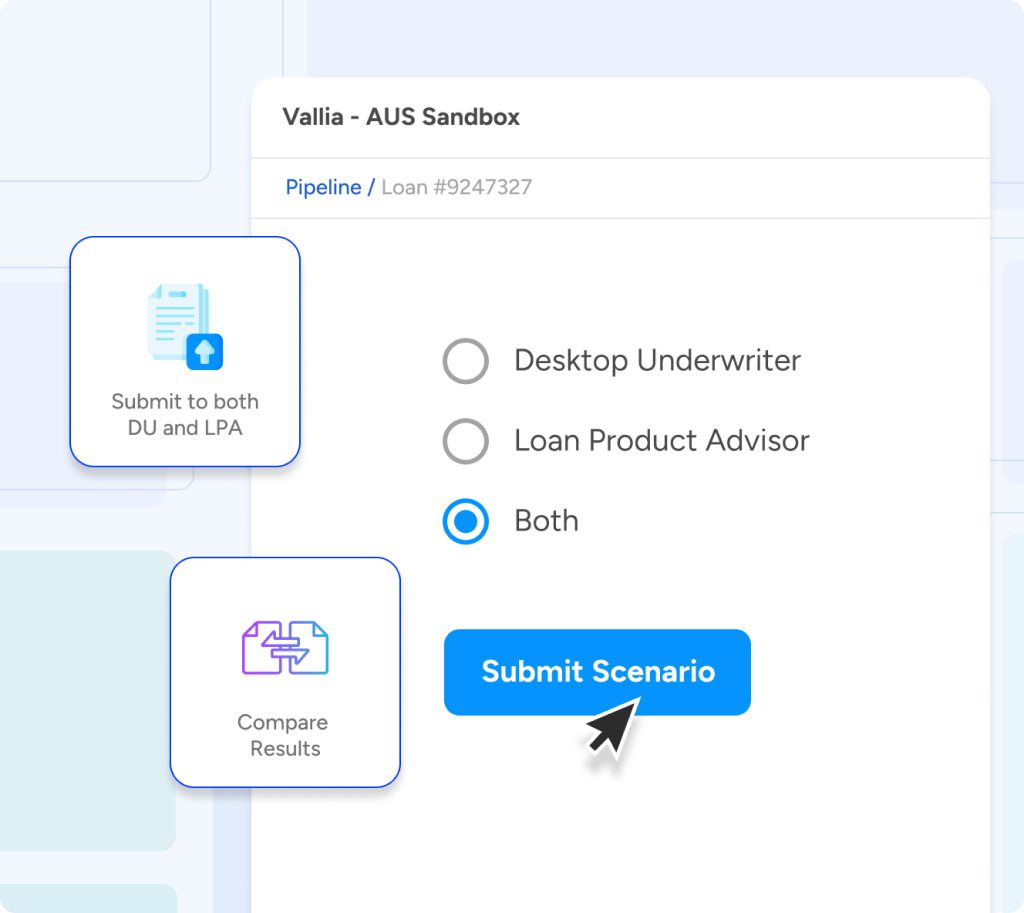

AUS Sandbox

Unleash your lending process with unparalleled flexibility and control. Effortlessly optimize loans while maintaining compliance.

Our user-friendly platform enhances efficiency and profitability, streamlining submissions to both DU and LPA with just one click. Experience seamless side-by-side comparisons and detailed insights to maximize your lending potential.

Why Choose Our Solution Suite

We design solutions that sit inside the workflow, where they reduce strain and bring clarity to the next step. Each component of the suite is focused on a specific point of impact—document validation, AUS submissions, disclosures, or back-office processing—so every improvement is both practical and measurable.

What sets the Brimma Suite apart is its balance of flexibility and consistency. The tools adapt to your process while delivering outcomes you can count on, loan after loan. Together, they create an environment where teams can move faster, compliance remains strong, and borrowers experience a smoother process from start to finish.