AI in Charlie

Artificial Intelligence is often promised as the future of mortgage lending. At WILQO, we’re making it a reality—today. Through Charlie, our cloud-native Production Optimization Platform, AI is no longer theoretical. It’s practical, precise, and purpose-built for the mortgage industry.

How AI Supports Mortgage Operations in Charlie

Charlie applies advanced technologies—such as Retrieval-Augmented Generation (RAG) and GPT-based models—within secure environments to support and streamline tasks that are repetitive, time-sensitive, and data-dependent.

AI Document Workflow Automation

Using Intelligent Character Recognition (ICR), Charlie supports:

-

Document Detection: Identifies missing required documents and prompts borrowers.

-

Automated Categorization: Recognizes and organizes uploaded documents without manual input.

-

Data Extraction & Verification: Pulls key data from documents and checks for accuracy.

-

Workflow Activation: Uses extracted data to trigger specific next steps within the loan process.

These capabilities reduce the time and manual effort required for document review while maintaining accuracy.

How AI Works in Charlie

Charlie is developed with an architecture that enables AI to be applied responsibly and effectively:

-

Atomic Work Capture: Each action is recorded independently with full context and time stamps.

-

Event-Based Data Storage: Data changes are stored chronologically for full auditability.

-

Parallel Workflow Support: Multiple users and systems can work without delays or lockouts.

-

Dynamic Data Handling: Interfaces adapt based on user roles and workflow status while maintaining data integrity.

-

Secure Infrastructure: All data is encrypted, and access is governed by structured permissions.

This foundation allows AI to access the data it needs in a secure and consistent format.

Learn How Our AI-Driven Production Optimization Platform supports your growth

Q: Is AI in Charlie designed to replace human roles?

No. AI supports users by reducing manual tasks and improving access to data. It is intended to assist—not replace—staff members.

Q: What distinguishes Charlie’s AI functionality?

Charlie’s architecture enables consistent, structured data capture. This supports the reliable application of AI tools that are integrated into existing workflows.

Q: How is data privacy maintained?

Charlie uses tenant-specific isolation, encryption, and role-based access controls. Shared models do not contain identifiable customer data.

More on AI Governance and Data Protection

Every aspect of Charlie’s AI implementation is governed by strong controls to ensure it aligns with privacy, security, and compliance needs:

-

Policy-Based RAG Queries: AI operates within clearly defined permissions and user roles.

-

Data Isolation: AI models do not contain customer-specific personal information.

-

Controlled Interfaces: Results are shown only through structured tools appropriate for user roles.

-

Encrypted Data: All information used by AI is stored in compliance with data protection standards.

These practices ensure that AI usage in Charlie supports safe and compliant operations.

Q: Do users need technical experience to use these features?

No. Most AI features are integrated into familiar workflows or use natural language interfaces, making them accessible without specialized training.

The Future of AI + Charlie

n addition to document automation, WILQO is developing additional AI features within Charlie, including:

-

Natural Language Configuration: Admins can set workflows and permissions using plain language input.

-

Voice-to-Application Capture: Conversations with borrowers can be transcribed and transformed into structured data.

-

AI Reporting Tools: Users can request data-driven reports using natural language.

-

Educational Content Generation: AI can provide borrowers with content based on their specific loan details.

-

Underwriting Support: AI can assist underwriters with suggestions and validation steps based on real-time data.

All new features are developed within the framework of secure access, data integrity, and regulatory alignment.

Features That Optimize Your Origination

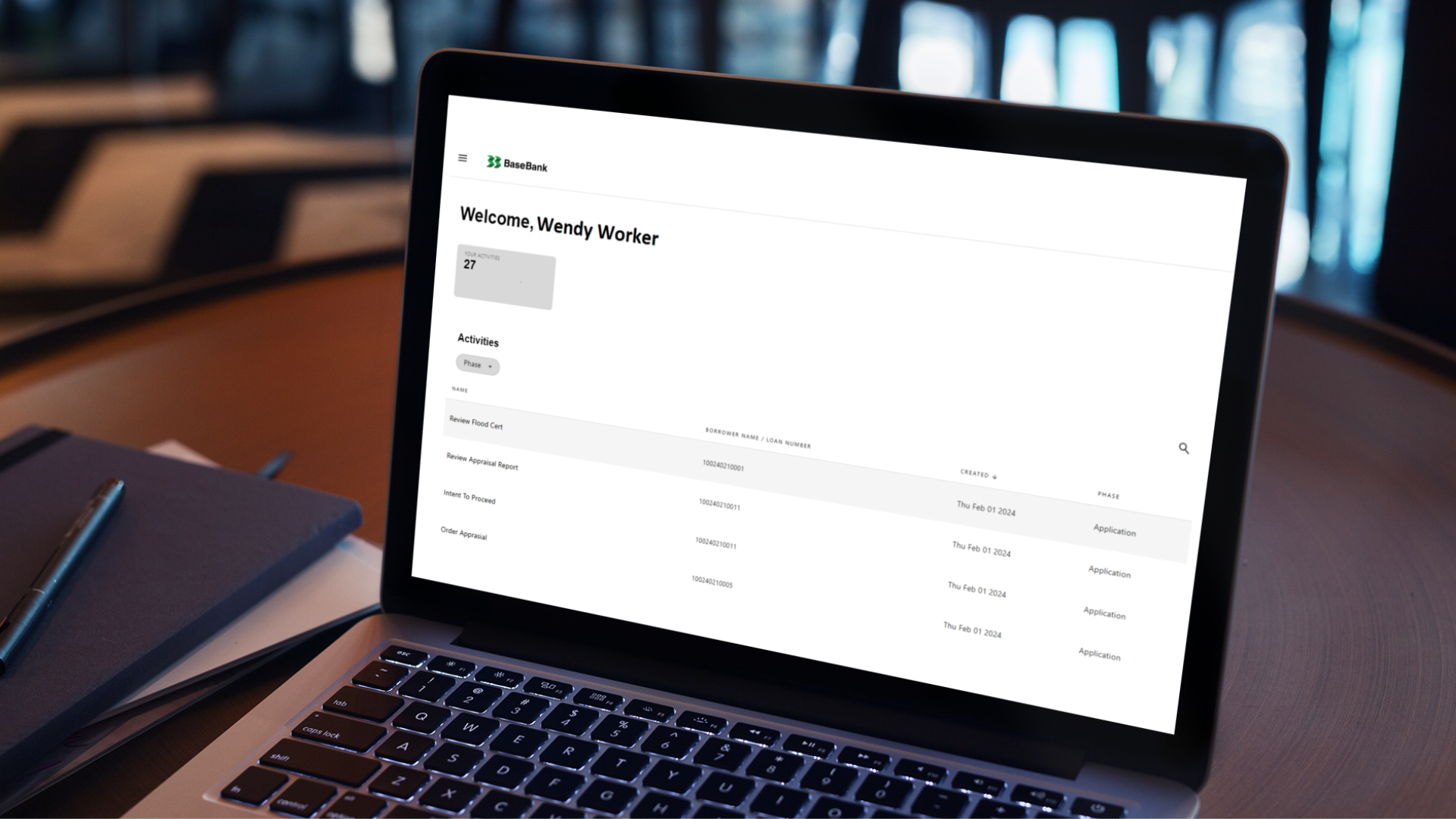

Efficiency is everything. Our Production Optimization Platform (POP), is designed to streamline your loan process, enhance compliance, and vastly improve your borrower experience.

One System

POS, LOS, Business Intelligence, Task Automation & More.

No Record Locking

Multiple users (and automated processes) can work on a single loan simultaneously.

Non-Linear, Parallel Workflows

Reduce the impact of bottlenecks! Our POP improves efficiency and cuts down cycle time.

Smart Automation

Built-in smart processes handle repetitive tasks, freeing up your team for more strategic work. No more third-party bots, everything is seamlessly implementd.

Complete Transparency

Track each loan's progress with our granular progress items. From compliance checks to borrower communication, every step is logged and visible, ensuring you stay compliant and in control at all times.

Book A Demo

Meet our POP, a single Mortgage Operating System that can be used across multiple channels.